DUBAI, UAE, March 3, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency change by buying and selling quantity, has launched its newest Bybit Commodity Insight Report. The report offers key insights into the macroeconomic and geopolitical developments driving gold’s bullish trajectory, analyzing the elements that would push the dear steel to new all-time highs.

Key Highlights:

- Bullish Outlook: Gold is anticipated to surpass $3,000 per ounce in 2025, supported by sturdy macroeconomic and geopolitical elements.

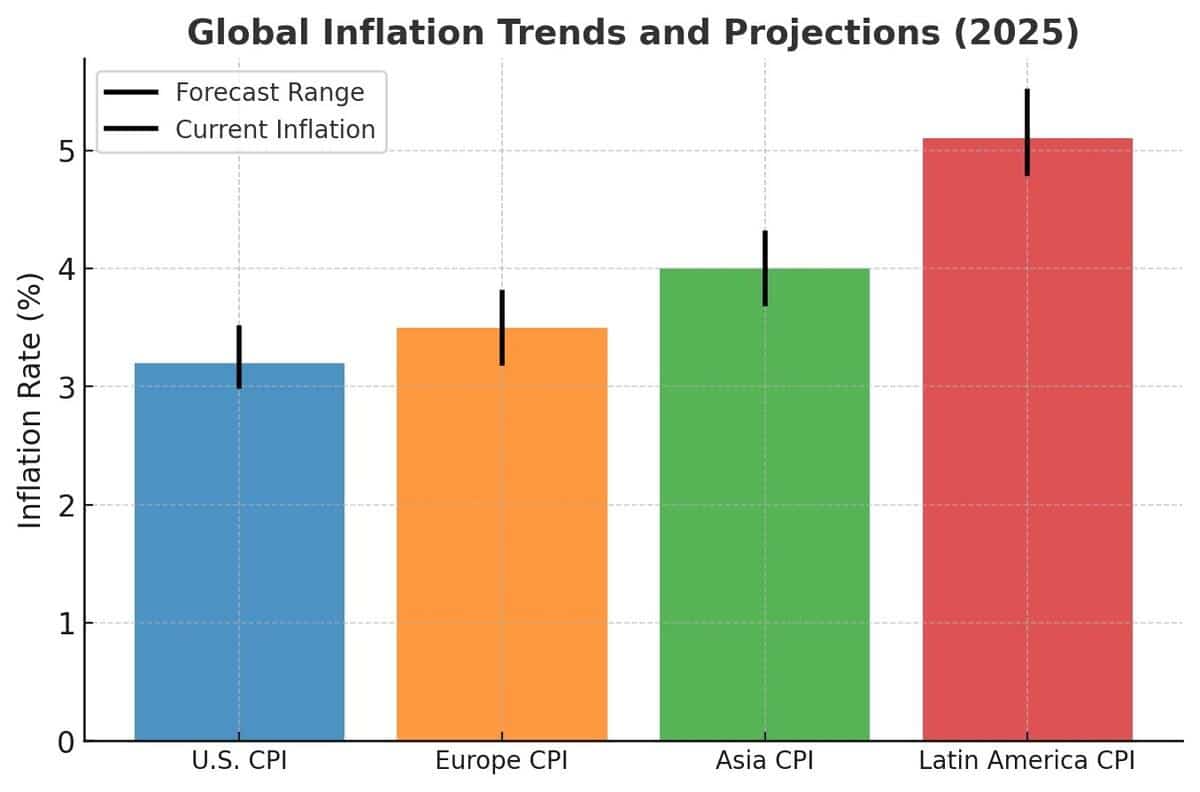

- Inflation Hedge: Persistent inflation above the Federal Reserve’s goal strengthens gold’s position as a hedge towards foreign money devaluation.

- Financial Coverage Shifts: Anticipated U.S. rate of interest cuts may increase gold’s enchantment over interest-bearing property.

- Geopolitical Tensions: International conflicts, together with U.S.-China tensions and the Russia-Ukraine struggle, are driving demand for safe-haven property.

- Central Financial institution Demand: Document-breaking gold purchases, particularly by China and Russia, present structural help for increased costs.

- Technical Momentum: Breaking previous $3,000 may speed up features towards $3,200–$3,500.

- Investor Confidence: Robust ETF inflows and speculative positioning sign a bullish market sentiment.

Macroeconomic Drivers

With inflation projected to stay above 2%, gold continues to function a hedge towards declining buying energy. The Federal Reserve’s anticipated fee cuts may additional enhance demand, as decrease actual rates of interest make gold extra engaging than fixed-income property.

Geopolitical Uncertainty

Ongoing conflicts and world instability are reinforcing gold’s safe-haven enchantment. Traditionally, gold has outperformed during times of geopolitical stress, with buyers turning to it as a hedge towards uncertainty. The present surroundings suggests this development will proceed.

Central Financial institution Accumulation

Central banks bought over 1,000 metric tons of gold in 2024, a development anticipated to persist as international locations like China and Russia diversify away from the U.S. greenback. This regular accumulation helps costs and limits draw back danger.

Technical Energy & Market Sentiment

Gold stays in a robust uptrend, with key resistance ranges in focus. A break above $3,000 may set off additional features, whereas ETF inflows and rising futures positions point out sturdy investor confidence.

Conclusion

Gold’s path to $3,000 is pushed by inflation, central financial institution demand, geopolitical uncertainty, and optimistic technical indicators. As world instability persists, gold’s standing as a safe-haven asset is anticipated to strengthen.

For a deeper evaluation of those developments, entry the total Bybit Commodity Insight Report from Bybit.

#Bybit / #TheCryptoArk /#BybitResearch/#BybitLearn

About Bybit

Bybit is the world’s second-largest cryptocurrency change by buying and selling quantity, serving a worldwide neighborhood of over 60 million customers. Based in 2018, Bybit is redefining openness within the decentralized world by creating a less complicated, open and equal ecosystem for everybody. With a robust give attention to Web3, Bybit companions strategically with main blockchain protocols to offer sturdy infrastructure and drive on-chain innovation. Famend for its safe custody, various marketplaces, intuitive person expertise, and superior blockchain instruments, Bybit bridges the hole between TradFi and DeFi, empowering builders, creators, and fanatics to unlock the total potential of Web3. Uncover the way forward for decentralized finance at Bybit.com.

For extra particulars about Bybit, please go to Bybit Press

For media inquiries, please contact: [email protected]

For updates, please comply with: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube